The Case of the Vanishing Oil Reserves

November 3, 2016

Where are Philip Marlowe and Sam Spade when we need them? A crime is in progress, and only a detective who’s unafraid of stepping on powerful people’s toes is likely to get to the bottom of it.

Here’s what we know. Someone is stealing the world’s valuable petroleum reserves right from under our feet—and getting away with it. Politicians and the news media are barely mentioning the heist; maybe they don’t understand what’s happening, or more likely they have something to hide. But this is big. It could be the caper of the century.

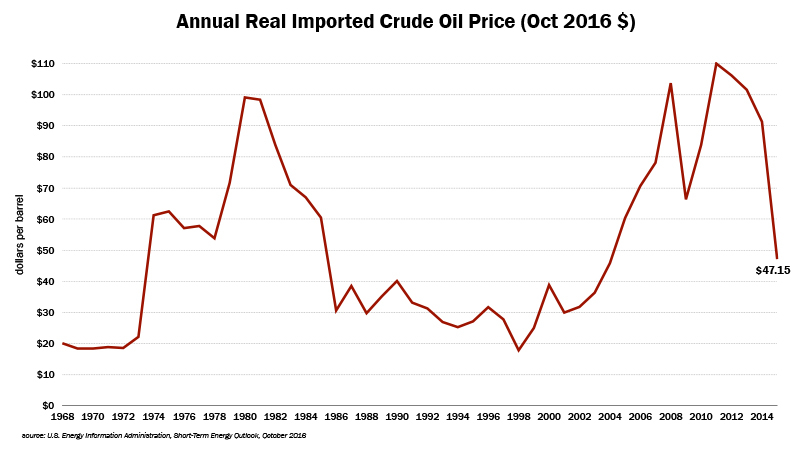

A fat clue landed on my doorstep last week hidden in the newspaper business pages. It was an article describing Exxon’s announcement that it was writing down 20 percent of its booked oil reserves. The article noted that Exxon blamed low oil prices. That sounded fishy. I decided to do a little sleuthing and discovered that, at $50 a barrel, inflation-adjusted world oil prices are no lower now than they were in the 1980s and ’90s, when reserves were growing every year. Why didn’t Exxon mention that?

Exxon’s not alone. Other companies have been engaging in similar write-downs. They all point the finger at low oil prices—almost as if they’re working together, trying to distract attention from the real culprit. But who? Who’s stealing those reserves?

Another possible clue showed up in a report from Carbon Tracker, an organization that assesses how much of the world’s fossil fuels will have to stay in the ground if we’re going to avert catastrophic climate change. Carbon Tracker figures that a very large portion of oil reserves is unburnable, and that oil companies’ balance sheets should be adjusted to reflect that. So is climate action stealing Exxon’s oil? I decided to investigate. It turns out that, while opinions about the future of fossil fuels matter, and Carbon Tracker is trying to shift those opinions, oil companies’ assets probably won’t actually be stranded for this reason until the nations of the world adopt a hefty carbon tax. So, for better of worse, climate action is not yet leading Exxon and other companies to write down their reserves. I’m not saying the victim of this robbery is any angel. A lot of people have reasons to hold a grudge against the oil industry. But climate action is not the culprit here.

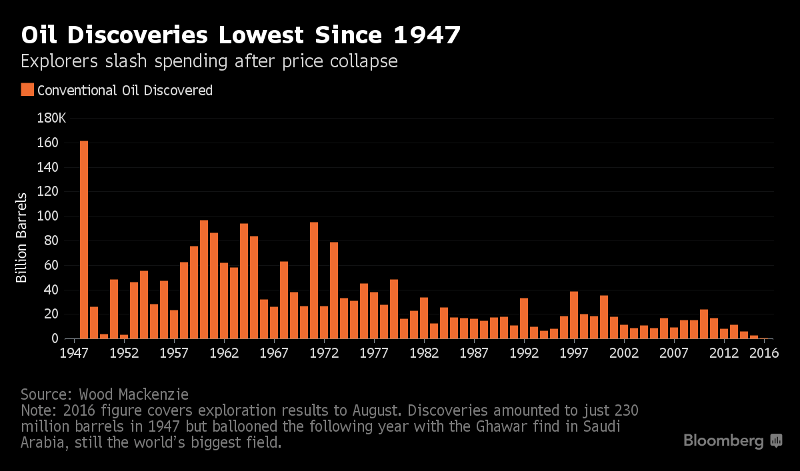

As I was dusting my computer keyboard for fingerprints, I accidentally clicked a link and landed on a Bloomberg article claiming that oil discoveries have been super-low the last couple of years. The article featured a breathtaking graph showing that the year 2015 yielded the fewest oil discoveries in decades—with 2016 on track to be even worse.

Are the petroleum companies themselves guilty? Are they stealing their own reserves by failing to look for more oil? It didn’t make sense. The oil companies are in business to make money, and the only way they do that is to find oil, extract it, and sell it. Why would they be undermining their own business? Again, it looked like they were hiding something—a secret so massive that they were willing to cut their own financial throats rather than divulge it.

Now, I’m no Hercule Poirot, but I’ve been around the block a few times. And if there’s one thing my years as a gumshoe have taught me, it’s that when somebody big wants something covered up, expect a red herring, a smoke screen, a patsy. It wasn’t long before a rosy-colored fish of the family Clupeidae showed up. And it was already starting to smell. It was called “peak demand”—an idea that a few well-placed economists were selling, which said people just don’t want oil so much anymore because they’re driving electric cars. That would explain low oil prices, which would explain lower investments in exploration. But that didn’t make much sense: as of the end of 2015, plug-in electrics represented 0.1 percent of the world’s one billion cars. And Americans were buying bigger gas-guzzling cars and trucks again. That fancy moniker “peak demand” didn’t really explain anything; it just diverted attention. Sure, a generally weak economy and a few years of high production output from frackers working in tight oil deposits in the U.S. had driven petroleum prices lower. But that just brought me back to the question: Why are those prices killing oil reserves now, while the industry operated just fine at similar or lower price levels in the past?

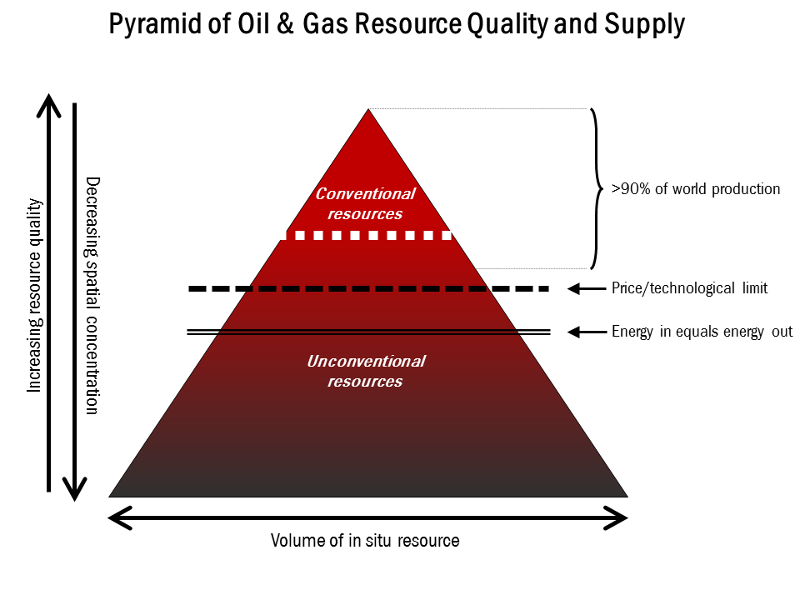

My head was starting to hurt. I tossed back a couple of stiff shots of bourbon; then, to put myself to sleep, I picked up what I thought was going to be another boring oil report—though it did have an intriguing title: “Drill Baby Drill.” It was written by a retired energy analyst who had worked for the Canadian government. Probably nothing here, I thought. But then I came across a graph on page 44, and a light bulb came on in my brain—more like a twenty thousand-watt movie marquee. That graph put all the clues together in a way that made sense for the first time.

After staring at the chart for a few minutes, I realized the real culprit in the vanishing oil reserves caper is a shady character known to his underworld contacts as “Depletion.” Here’s how he works his racket. We’re using more oil every single year, which means that every year we’re depleting what’s left even faster than we were the year before. Depletion always takes his cut before anyone else, and it’s bigger every time.

Also, we’re always going after the best oil first (drilling down from the top of the pyramid in the graphic), leaving the poorer prospects for next year. When we get to the “energy in equals energy out” line, it will take as much energy to drill, extract, and refine a barrel of oil as the finished product will yield to society. At that point, the oil industry, and all the other industries that depend on it (and if you think about it, they all do: how do we get raw materials, spare parts, food, or even solar panels without oil-burning trucks and container ships?) are toast. History. Already the cheap conventional oil is mostly gone; most of what remains is going to cost more to produce, refine, and distribute than society can pay for, which means the oil industry won’t be able to afford to deliver very much of it. Everybody loses—except Depletion.

The oil companies are writing down their reserves because at today’s prices they can’t afford to extract an ever-increasing fraction of their remaining oil. Depletion has already taken what’s affordable. That would be less of a problem if society could pay an arbitrarily high price for oil, or if it could afford to invest more energy in obtaining oil than the finished fuel delivers. But neither is the case.

Nobody is willing to name the culprit. Not Exxon. Not the government. Not economists. They all point to the immense size of the overall oil resource pyramid and say, “There’s enough for decades! Centuries!” That’s how he gets away with it. Depletion is stealing our future, and nobody is talking.

That’s a beautiful racket, when you think about it. It’s in nearly everybody’s interest to just go along and say nothing. There are only two ways to exit the oil depletion game: switch to other energy sources or just use less. A few people are doing one or the other, but as a society we are addicts through and through. So we all whistle a happy tune and make small talk.

And me? There’s not much I can do but write this little detective story. Sometimes you get the bad guy, sometimes you don’t. It’s all part of the job, but sometimes the job stinks.

Image credit: Ollyy/Shutterstock.com

The reserves went down because the price they use to determine reserves – set by the SEC went down.

It doesn’t matter if prices match the 1980’s, if it drops almost in half from one year to the next (as set by the SEC), the value of reserves declines by that much or more. Any reserves that require a price higher than the current SEC price to be produced, have to be removed as reserves.

We are NOT “addicted” to oil, we are TOTALLY DEPENDENT UPON OIL FOR OUR VERY EXISTENCE! Our food is seeded, planted, grown & harvested with OIL, it’s preserved & transported to our shops with OIL, OIL is in everything we touch, eat or hear other than wild things, for us in the rich world it’s life itself!

It’s life too for most of the third world as OIL is used to pump water up from wells, it’s fertilizer, pesticides, herbicides & medicine, OIL is also life for most people in the 3rd world.

Without OIL, 95% of the worlds population will DIE!

Our soils have been abused, poisoned, & exhausted through “modern” farming methods that are very energy dependent & unsustainable.

Organic farms will take time to get their production up thanks to those abused soils but the land is owned by huge corporations & they won’t give up that land until forced too. Even so, organic farming cannot feed 7.5 + billion humans, we will have a massive die off.

We are not “addicted” to oil, we STUPIDLY FED our GROWTH with a TEMPORARY resource & now we are in a deadly trap of our own making.

I get a monthly letter from a Petro media site, Pennwell, and one other thing caught my attention—-there’s a big hoopla now in the extraction biz about how computer modeling overestimates reserves, and there’s conferences now as to what to do about it. So they’ve hoodwinked themselves with dependence on information technology, too.

Thanks for debunking the “Peak Oil Demand” thing—it struck me as mighty suspicious. It’s still the same Peak Oil scenario that was outlined early on. I am betting on World War for oil in De Rump’s term of office. Michael Klare said a long time ago that wars will be fought for the fuel to power the machines that fight them.

I wonder where EROEI payback erosion starts to severely limit economic growth? Maybe we reached that limit a few years ago at $80/bbl oil? Maybe this is a key reason we’re floundering with 1% GDP and massive debt today? It’s instructive to look at total cost of energy per household and how that total cost has increased over the last 15 years, last I checked somewhere around 12-14% of income. EROEI assures that net energy costs will continue to grow, and I can’t imagine industrialized families affording 20-25% of income on energy. Such a huge expense assures that we’ve reached the economic growth limits of fossil fuels. Peak Oil theories were correct. And economic-energy depletion is just one of many severe asymptotes in our near future.

MA, consensus estimates on fossil fuel show demand increasing for another 20-25 years, from 93mb/day today to around 110-120mb/day at peak demand. Wish it wasn’t so. Richard puts the global number of IC vehicles at 1B, but that may be a tad high, though projections show well over 1B IC cars in use by 2040, with growth demand mostly in developing nations (China, India, Nigeria, SA, EE, etc.). Last estimates I’ve seen show EVs and hybrids outselling IC beginning around 2032, but ICs continuing to sell well into 2040s.

Now that OPEC (the world’s only swing provider) finally seems ready to ramp supply back down to actuarial maxima, look for oil to return to trend, which is somewhere around $70-80/bbl. Some analysts are expecting a brief related spike, perhaps in the $150/bbl range. U.S. shale plays will peak around 2021, accelerating the average global bbl price, though I’m pretty sure we’ll find a number of new shale oil reserves in places around the globe. No matter, the end result is clear — EROEI limiting global economic growth. Peak Oil 101.

EROEI

this may not be the way to think about the value of oil.

The assumption is that all energy comes from oil, and when this limit is reached, the jig is up.

If you think of oil as an incredibly convenient energy source, it might be worth expending more energy to get it than it returns.

An example might be batteries. They consume more energy than they return.

“The assumption is that all energy comes from oil,”

No, that is not anyone’s assumption. Alas, all energy on Earth ultimately comes from the sun.

“If you think of oil as an incredibly convenient energy source, it might be worth expending more energy to get it than it returns.”

If oil is the only practical energy source for a certain end-use, then certainly it could make sense to expend more “net outlay” of a different kind of energy to recover oil. But, to my knowledge, there’s no precedent for this idea. EROEI is, indeed, valid in all cases of oil production.

“batteries consume more energy than they return.”

Apples and oranges. Batteries are not an energy source (like oil). Batteries are a reusable energy storage and delivery device. Batteries have a different kind of value than fossil oil, not the least of which is being re-chargeable by solar-sourced energy, in which case batteries can be seen as “providing” far more energy than was used to build the battery.

Yes … and No.

Plenty of people on this planet are unreliant or minimally dependent on oil. It is the West/North that is dependent on/addicted to oil.

If oil were to stop flowing tomorrow we would not see a mass extinction event although most people (in the West) would be extremely uncomfortable for a time as we make the adjustments and some people would indeed die.

You are right about our abused soils and it will take time to rebuild them but the majority of food across the world is grown ‘organically’, ie, without chemicals and there is plenty of food to feed the human population. Organic farming is MORE productive than chemical farming (look up forest gardens to see the most productive examples) and we could feed even 10G humans with food produced without chemical fertilisers and poisons. And it would be more nutritious!

In the same way as addicts are described as being drug-dependent, it is true that we are dependent on oil. The term addiction is suitable to describe our situation. Your final sentence [bar the first clause] actually describes addiction well!

I sincerely hope that we HAVE reached the limits of economic growth. We do not need economic growth; we need to move to more sustainable levels of consumption of EVERYTHING. Oil is an important part of that but we are up against the limits of so many things. We need to use less and—perhaps more importantly—waste less.

As pointed out by the Sustainable Development Commission seven years ago, we need prosperity rather than growth: http://www.sd-commission.org.uk/publications.php?id=914

… and batteries do not damage the planet with every ‘toe’ provided in the way that oil does!

I wonder how long government subsidies will allow us to pretend everything’s hunkey-dorey?

Agreed. It’s a different conversation, but fiscal/tax/labor/domestic policies, written by and for ultra-wealth special interests (i.e., K St, Wall St, Dark PACs, Offshore, whitewashing think-tanks, ALEC, etc.) have caused 3+ decades of increasing socioeconomic imbalance, not just in USA, but in most industrialized nations. And, yes, we are at severe asymptotic limits with any number of vectors: energy, water, climate / CO2, population, arable land, strategic minerals, rain forests, debt, etc..