Goodbye Administrative State, Hello Community Resilience

April 5, 2017

White House strategist Steve Bannon’s project for the “deconstruction of the administrative state” appears to be out of the starting blocks and well on its way toward a glorious victory lap. Using executive orders and other directives, President Trump has so far:

- Curbed several of President Obama’s climate regulations, notably the Clean Power Plan to move America away from coal dependency.

- Ordered a review of tougher U.S. vehicle fuel-efficiency standards put in place by the previous administration.

- Directed the Treasury secretary to review the 2010 Dodd-Frank financial regulatory law.

- Instructed the Labor Department to delay implementing an Obama rule requiring financial professionals who are giving advice on retirement—and who charge commissions—to put their client’s interests first.

- Instructed agencies that for every new regulation introduced, two existing ones need to be abolished.

- Required every agency to establish a Regulatory Reform Task Force to evaluate regulations and recommend rules for repeal or modification.

- Revived the Keystone XL and Dakota Access pipelines.

- Imposed a hiring freeze for federal government workers (excluding the military) as a way to shrink the size of government.

- Directed federal agencies to ease the “regulatory burdens” of Obamacare.

But that’s not all. The president has nominated officials who clearly intend to gut the agencies over which they will preside (notably Betsy DeVos at the Department of Education, Scott Pruitt at EPA, Alexander Acosta at Labor, and Rick Perry at Energy). And he has submitted a proposed budget that would dramatically cut funding for every department other than the military. Environmental, worker, financial, and consumer regulations are about to disappear by the batch, bale, and bushel. While the Reagan and Bush II administrations sought to aggressively weed out unwanted federal rules, Trump appears to be taking a flamethrower to the entire garden patch.

It is all happening so quickly that it’s difficult to mentally process the implications. By itself, the repeal of the Clean Power Plan is momentous: it effectively cedes U.S. leadership on international efforts to combat climate change (as if to dispel any doubt on the matter, Trump is considering withdrawing from the Paris climate accord). Two decades of work by climate activists have crumbled with the stroke of a pen. Some environmentalists have put on a brave face, pointing out that efforts by states like California to promote solar and wind power won’t be affected. But the current national build-out rate of renewable energy generation capacity is only about a tenth what would be required to produce the amount of energy needed, in the time required, to avert some combination of catastrophic climate change and economic disaster (and that’s if wind and solar technologies are even capable of powering a consumer economy on the scale of the U.S.; as of now, they probably aren’t). Obama’s efforts probably constituted a step in the right direction, but they were far from sufficient. Now even that tentative momentum has been broken, and it will be years before the nation can win back a similar level of federal effort to rein in greenhouse gas emissions. But climate change won’t wait; we really don’t have four or eight more years to waste.

The implications for education, health care, labor, and financial regulation are just as dire on their own terms, even if they don’t threaten global catastrophe.

Maybe it would be helpful to step back a minute and recall why the administrative state came into being in the first place. In the year 1900 it barely existed: there were no U.S. Departments of Labor (established in 1913), Health and Human Services (1953), Housing and Urban Development (1965), Energy (1977), or Education (1979); nor was there an Environmental Protection Agency (established in 1970). Social Security, Medicare, Medicaid, and unemployment insurance hadn’t appeared yet; neither had the federal income tax. The role of the national government was far more limited in those days: its main duties were to conduct foreign policy and wage war, manage federal lands, regulate interstate and foreign trade, and make and enforce national laws—most of which had to do with property rights. The national budget represented about 5 percent of GDP (today the figure is about 21 percent).

Photo: Child labor in Indiana Glass works, 1908. Public domain

In many ways, this was the Golden Age of free-market capitalism. At the time, however, it was gradually dawning on a lot of people that unrestrained industrial commerce was creating side effects that might increasingly drag down the further expansion of the system. As Karl Marx had observed, capitalism was generating greater economic inequality—a trend that meant the poor would eventually become so numerous and disgruntled as to revolt (as soon happened in Russia); it likewise meant that an ever-larger portion of the populace would be unable to afford factory-made goods, and the resulting decline in the customer base could ultimately lead to the bankrupting of factory owners. Meanwhile it was also becoming apparent that environmental pollution could so imperil the health of workers as to impose serious costs on the owners and managers of industry (as Chinese leaders have recently discovered)—not to mention workers and their families. Economists coined a useful term to describe these kinds of impacts on society: externalities, which are defined as consequences of an industrial or commercial activity that affect other parties without being reflected in the price of the goods or services sold. Without some kind of regulation and reform to either reduce externalities or force industry to pay for them, capitalism would eventually drown in its own effluent. Since industry was incapable of managing externalities on its own, it was up to government to do the job.

At the same time, the industrialization of agriculture was sending a growing stream of people from farms to cities. And employers needed a mobile work force able to supply labor when and where the market demanded it. The result was that ever more people became dependent on wages and markets to supply all the supports and goods that formerly sprang from farm and family. But wages and markets were fickle. During the miserable years of the Great Depression, the government began stepping in to guarantee more of what land-based traditional communities used to provide, if imperfectly: support in old age and during hard times. Entitlements in the forms of Social Security, Medicare, Medicaid, unemployment insurance, food stamps, and veterans’ programs eventually formed a new social safety net.

Regulations imposed costs of compliance on industry. And providing entitlement programs was expensive, so paying for them required higher taxes. The result was a bigger, more complex government. The notion of big government has always irked some, particularly wealthy industrialists who don’t want to shoulder the burden of their own externalities. Over the past few decades, industrialists and financiers funded a network of think tanks and lobbyists to push for fewer regulations or ones designed to favor particular industries or companies; to the same end, they also funded the election campaigns of thousands of business-friendly candidates for state and national office across the country. Meanwhile, labor unions, public interest groups, and environmental organizations stitched together a countervailing web of institutions to lobby for regulations.

Given the obvious benefits of environmental and worker protections and entitlements, one might think there would be near-universal support for them among the general working public. With regard to entitlements that’s mostly the case; indeed, the faux-populist presidential candidate Trump repeatedly promised not to touch Social Security or Medicare. However, the industrialists who funded anti-regulation think tanks also bankrolled a decades-long public relations effort to convince Americans that regulation is their enemy—it takes away freedom, costs them money in taxes, and kills jobs. The hard-core free-marketers also hate entitlements and have always wanted to privatize Social Security, but this view has been much tougher to transplant to Main Street America.

With the advent of Trump, decades of patient anti-regulatory persuasion bore fruit. The candidate appealed to voters who wanted more and better jobs and who had come to scorn a Washington bureaucracy that was increasingly complex, distant, and corrupt. Trump convinced his constituents that slashing regulations and reining in the bureaucracy would give more power to ordinary folks, but of course most of the benefits will accrue to big businesses, which have much more interest in automation than in job creation. A prime example is Trump’s de-regulation of the coal industry, advertised as a way to bring back thousands of jobs. In reality, the U.S. coal industry was on the skids long before Obama’s Clean Power Plan came along, and more coal jobs have been lost to automation than to government interference. But few of the working people who voted for Trump are interested in those facts, nor will they keep score on how many new jobs actually appear as a result of the president’s actions. By now the nation’s political polarization has proceeded so far that seeing hated liberals get their comeuppance is satisfaction enough for Trump voters, even if the bargain entails breathing dirtier air, drinking polluted water, and getting taken in by financial scams.

Meanwhile the wholesale destruction of federal rules and regulations is a truly catastrophic development both for the uncounted throngs of people in social movements, NGOs, and unions who have worked for decades to craft or advocate for polices to temper the capitalist industrial system, and for the people and ecosystems they sought to protect. The one thing the social movement and environmental activists and Trump can probably agree on is that it is far easier and quicker to destroy systems than it is to build or rebuild them.

* * *

So far, this tale of the administrative state’s gradual construction and rapid demise should be fairly transparent to students of U.S. political, social, and economic history. But there is a deeper layer to the story that few understand. The spectacular growth of the American economy during the twentieth century was almost entirely due to the one-time-only harvesting of extraordinarily bountiful energy resources in the forms of oil, coal, and natural gas. Cheap, abundant, concentrated fuels made many things possible: the industrialization of agriculture, and hence the growth of the middle class; the revolutions in transport resulting from automobiles and aviation; the powering of assembly lines and the automation of resource extraction and industrial production; and the electrification of the country, bringing extraordinarily diverse energy services literally within reach of everyone.

These fuels were extracted from Earth’s crust using the low-hanging fruit principle, meaning that the highest-quality and cheapest-to-access resources were targeted first. After more than a century of ever-rising extraction rates, the best of the world’s petroleum—the most important of the fossil fuels—has been burned once and for all time. The costs of oil production are rising fast (over 10 percent per year over the past decade) while the ability of customers to pay for gasoline is not. Therefore the price of oil these days is always either too low to yield profits for producers, or too high to enable further expansion of the overall economy. The oil industry has tried to paper over this gaping conundrum with a massive increase in debt.

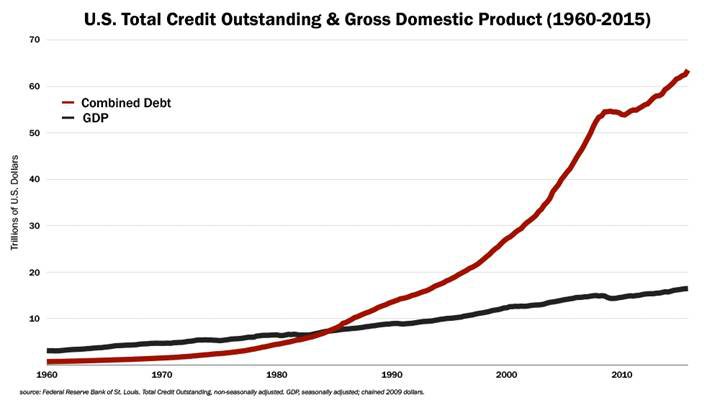

Debt has proliferated throughout the rest of society too. With rapid GDP growth during the last century, institutions arose that depended on further growth. Debt was a way of monetizing optimistic expectations: consume now, pay later. Today, government debt, corporate debt, and household debt have reached staggering levels never before seen. Meanwhile, averaged real economic growth has been slowing for the past two or three decades, and I’m among a growing number of observers who argue that the twentieth-century era of growth is rapidly coming to an end.

It’s helpful to view these trends in comparative perspective, looking at the histories and trajectories of other societies that have grown to heights of wealth and sophistication. Perhaps the most useful work on the subject is Joseph Tainter’s classic The Collapse of Complex Societies (1988), which explores the relationship between energy and societal complexity. According to Tainter, societies solve problems with complexity, but complexity costs energy. Eventually returns on investments in complexity begin to erode and may even turn negative (more complexity actually makes problems worse). At that point societies begin to collapse, shedding complexity until they reach a level of functioning that can be sustained with still-available energy and resources.

The gutting of the administrative state can perhaps be seen as a reduction of systemic complexity. Should we regard the Trump slash-and-burn attack on government as a sign of collapse, or a strategy to postpone it?

Let’s think through the implications of the latter view. Suppose for a moment that Trump and his advisers are either directly familiar with Tainter’s work, or merely have an intuitive grasp of the principles that Tainter identified. Just about everyone agrees that the federal government is too bureaucratic and wasteful. (A small but telling example is the government’s procurement website, SAM.gov, which cost almost $200M to build and is hugely buggy.) Maybe Trump and Bannon believe that the United States is in crisis and the only way to preserve the system is to shed a few of its layers of complexity. Their hypothetical conclusion actually makes sense up to a point—but then one has to address the question of which layers of complexity are best discarded. As we have seen, the administrative state was built in order to solve real and imminent problems. Take it away and those social and environmental problems will bite with a vengeance. After all, they have been held at bay only marginally. We did a reasonable job of reducing smog in Los Angeles and keeping the Cuyahoga River in Cleveland from continuing to catch fire, but climate change, ocean acidification, and soil degradation are much bigger threats that we’ve barely touched. Plus, economic inequality is now back to 1900-era levels, even with a raft of entitlements in place. Simplifying the system according to the Trump formula might not be so smart, and the effort will certainly not go uncontested.

That’s because there are plenty of people who believe we need more of an administrative state. Social movements, environmental NGOs, and what’s left of the labor unions are pushing for universal health care, stronger climate regulations (such as a carbon tax), and perhaps even a universal guaranteed income. These, after all, were the sorts of programs that at least partially solved a range of problems during the growth phase of the American industrial system, and that in stronger forms work well in other countries (of which Norway is now the happiest). As social and environmental problems proliferate, what else are we to do? Further, a good argument can be made that at least some regulatory and entitlement programs do not really add much complexity: indeed, a single-payer health care system might actually be significantly simpler than America’s current byzantine web of insurers, providers, policies, and deductibles.

Are there other, better opportunities for reducing societal complexity? Maybe it would make more sense to seek simplification in the areas of the system that most threaten its overall stability. Two obvious candidates are the financial sector and the energy system. For the past four decades, America’s financial system has grown faster than any other segment of its economy—by piling on debt. And as we’ve seen, debt levels are now unsustainable. Previous societies have been able to extricate themselves from similar dilemmas in only one way—by forgiving debt, cancelling it, and repudiating it on a large scale. This will eventually happen, quite literally by default, one way or another; why not get ahead of the curve by managing a financial collapse? If it were managed really, really well, perhaps it might not even feel like a collapse.

Similarly, with regard to the nation’s energy system, business-as-usual is a pathway to guaranteed crisis, and the only sensible (though admittedly difficult) way forward is to begin dramatically reducing energy production and consumption. Doing so is the main realistic pathway (along with reforestation and agricultural reform to store carbon in trees and soils) to dealing with the climate crisis, which is truly an existential threat. I say this having spent a year researching and co-authoring a book (Our Renewable Future, with David Fridley, 2016) on the prospects for fully transitioning society to run on renewable electricity; the short of it is that, even if well-funded, such a transition would still probably require us to use a lot less energy. Yes, using substantially less energy would reverse economic growth. But growth is ending anyway: we need to restructure the economy so it can provide what we really need (food, basic services) without the expectation of continual expansion. Maybe one way to do this would be to heavily tax carbon-based energy and use the money to provide more of a basic social safety net so that the human impacts of economic shrinkage could be minimized. I have made more suggestions along these lines in another book (The End of Growth, 2011). It would also help to incentivize smaller families; that way per-capita energy would not have to fall as quickly as total national energy usage.

Of course, none of these things is happening now, and won’t until the Trump administration is history and crisis (perhaps in the form of another financial crash) returns, forcing us all to question the status quo and requiring us to make heroic sacrifices and engage in a concerted effort to redesign and repair our societal systems.

All of this reasoning leads me to conclude that the Trump attack on the administrative state is more a sign of collapse than a serious (or well thought out) effort to push back against it.

If our national political-economic system is crumbling, and if the folks currently in charge of it have no reasonable plan for preventing it from disintegrating further, then many problem solvers are perhaps better off shifting their attention to local (and therefore often insufficient) efforts to deal with problems like climate change, economic inequality, and financial fragility—even though city, county, and state policies along those lines might be subject to pre-emption at the federal level (a good indicator in this regard will be the Trump administration’s response to California’s determination to maintain high vehicle fuel efficiency standards). There’s a silver lining here: localism is one of the most-discussed solutions to the over-complexity of our system, and most people are supportive of the notion of stronger, more self-reliant, and more resilient communities. The downside is that not all localities will be equally proactive or successful in their efforts to build community resilience.

Whether Donald Trump is somehow turfed out of office soon, or remains in place for the next few years to make an even deeper mark on history, we’re nevertheless seeing a fundamental turning point in the evolution of the American system of governance. Though this is likely a transitional moment and not a persistent “new normal,” the Trumpist jihad to eliminate the administrative state still marks the end of the period in which all of us grew to maturity. We’re in a new era, like it or not.