USGS Downgrade of Recoverable Oil in the Monterey Shale of California

October 7, 2015

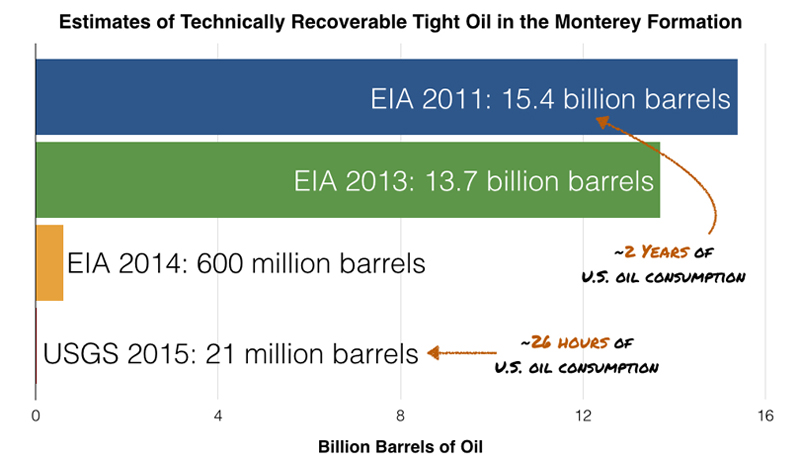

In 2011, the EIA published a report that stated the Monterey Shale in California had 15.4 billion barrels of recoverable oil, or two-thirds of the then estimated recoverable tight oil in the US. The EIA subsequently downgraded its estimate to 13.7 billion barrels in 2013. Post Carbon Institute and PSE Healthy Energy doubted the veracity of these estimates, and I worked with them to assess the EIA’s claims by analyzing available drilling data and the geology of the Monterey formation. In December 2013 they published my report, Drilling California: A Reality Check on the Monterey Shale, which concluded that the EIA’s estimate was vastly overstated. A few months later, the EIA quietly downgraded its estimate by 96% to 600 million barrels, but the revision was picked up by the Los Angeles Times in May 2014.

Yesterday the U.S. Geological Survey (USGS) released a report stating that the mean technically recoverable oil resource in the Monterey was just 21 million barrels, a further 96% downgrade from the revised 2014 EIA estimate.

To put this in perspective a resource which in 2011 the EIA estimated was 15.4 billion barrels—enough oil to meet all of U.S. needs for over two years—has been reduced to 21 million barrels, or enough oil to meet U.S. needs for only 26 hours. The initial estimate caused wildly overblown optimism within industry and government on the energy and economic future of California and major concerns within environmental groups about the effects of fracking to recover these resources on the environment.

Unfortunately, the excessive estimates for the Monterey are not the EIA’s only episode of unfounded optimism. I have since looked at EIA estimates for all major tight oil and shale gas plays in the U.S. and found them highly to extremely optimistic when analyzed in the light of actual drilling and production data (see Drilling Deeper; Shale Gas Reality Check and Tight Oil Reality Check). Nor does it appear that the EIA has learned from its mistakes. In the most recent Annual Energy Outlook, the EIA raised its projections for cumulative oil production from the Bakken Play (the 2nd largest in the U.S.) by 85%—despite the fact that production in the play is already down more than 5% from its December 2014 high, and would require the production of twice as much oil through 2040 as the 2013 USGS assessment estimated was technically recoverable from the play.

The people of the United States are not well served by unrealistic and overblown forecasts. Future energy supply is a huge concern and realistic forecasts are crucial in formulating energy policy to ensure future sustainability.

21 million barrels using intensive means. 13.7 billion using both conventional and nonconventional means. Apples to oranges, guys. C’mon.

The original EIA estimate of 15.4 billion barrels (later downgraded to 13.7 billion before it was downgraded further) was for “shale oil”, i.e., unconventional production. See: http://shalebubble.org/drilling-california/ and http://www.latimes.com/business/la-fi-oil-20140521-story.html and page 75 of http://www.eia.gov/analysis/studies/usshalegas/pdf/usshaleplays.pdf.

The USGS assessment of the Monterey assessed continuous “tight oil” from source rocks in the Monterey is analogous to tight oil plays elsewhere. They found a mean estimate of 21 million barrels in the Monterey. This is directly analogous to the previous Monterey “tight oil” estimates of the EIA of 15.4 billion barrels, 13.7 billion barrels and most recently 600 million barrels. The USGS did not include conventional resources from the many legacy fields in the San Joaquin basin which have produced a lot of California’s oil and will continue to do so (many of which contain oil migrated from Monterey source rocks). Everyone knows about the legacy fields, the point being that unconventional oil from the Monterey was supposed to be the new bonanza, based on analogy to other tight oil plays like the Bakken. It clearly isn’t. There is no newfound bonanza as indicated by the Drilling California report (www.shalebubble.org/drilling-deeper), this new USGS assessment and the EIA’s 96% downgrade in May 2014 – hence this post. Your suggestion that the EIA’s 13.7 billion barrel estimate for the Monterey included conventional oil is incorrect.

The USGS report looked only at the San Joaquin Basin, one of four basins that make up the 1,750-square-mile Monterey Shale formation. Upcoming USGS reports will estimate the recoverable petroleum in the other three basins. Another U.S. Geological Survey study (http://pubs.usgs.gov/pp/pp1713/, 2007) estimated 393 million barrels of oil are recoverable by conventional drilling in the San Joaquin basin of the Monterey Shale.

We should not try to make information available suit our aims…

While I am supportive of initiatives to broaden the base of our energy sources and especially increase unconventional, clean energy sources, I am saddened to see such stories, which discredit serious concerns about our real energy predicament, if we take a longer term view.

In today´s cheap energy environment, it is easy to suggest that reserves are illusory at today´s prices, but we must focus on long range solutions and new approaches, without distortions in interpretations of newly available information.